The Covid-19 Strike: The Impact on Insurance Industry & Ways to Mitigate Risk with AI

The outbreak of Coronavirus disease (COVID-19) since December 2019 has been causing the entire world chaos and threatening human lives with the rapid transmission speed. The total number of confirmed cases have reached to more than 415,000 and nearly 18,500 of deaths based on World Health Organisation (WHO). Many countries had imposed lockdown to combat the spread and does it brings negative impacts to the Insurance industry?

Potential Impacts on Insurance Industry

Many of us might expect losses from canceled events, travel disruptions and potential medical claims for insurance industry due to the unprecedented number of infected cases and the lives that had been taken by Covid-19. However, the world’s largest insurers have learned lessons from previous epidemics such as SARS, MERS, Zika, and Ebola, to tightened up their policies by excluding infectious diseases to prevent potential losses. Thus, claim loss has a low impact to the insurance industry in short term. The potential impacts on insurance industry are listed and described as below:

- Potential government enforcement on insurance claims – If the pandemic disease is prolonged, government might impose special enforcement on insurance companies such as allowing certain infectious diseases claim to help on country’s economic. Insurance companies might require extra time and effort to investigate tons of incoming digital claims from preventing frauds and might encounter huge claim loses.

- Increase operational risks – Since most of the countries had imposed lockdown, the sales and operation process must be digitalised to keep the business running smoothly online. However, some of the insurance companies are still relies heavily on face to face interaction without advanced digital tools. Thus, it might be challenging for them to handle the heavy online interactions with customers and distributors and offsite work management for the employees which significantly reduce their operational efficiency and impact the customer satisfaction if no immediate action taken.

How Insurance Companies could Mitigate risk with AI

In times of uncertainty and financial stress, it is increasingly important for the insurance sector to maintain connections and be well-positioned to react to the pandemic situation in order to mitigate all potential risks. The powerful AI-powered digital tools are very essential for the insurance companies to perform productive planning, training, and outreach across company, intermediary, and client stakeholder groups. Here’re some of the methods that will be beneficial for the insurance sectors with AI:

1. Optimise Resources and Cost Efficiency with AI-powered Customer Services Process

The purpose of deploying an AI-powered chatbot is to understand and answer the bulk of customer or client queries over email, chat and phone calls. The pandemic outbreak caused obvious shift in consumer behaviour especially moving toward online instead of physical visit. Therefore, we can see a sudden increase in online queries which are exceeded the usual capacity with the available workforce. The typical ways of solving this problem are either hiring more live agents or deploying chatbot.

Hiring more live agents is the most direct way in solving the issue but it requires times to go through entire hiring process and you will never know how many live agents are enough to handle the increasing number of online interactions especially when unexpected dynamic event happen like global pandemic. Thus, AI-based chatbot is a better choice for organisations to handle heavy traffic of online interactions with immediate responses to the frequently asked questions that can significantly enhance customer experience by eliminating the waiting time for voice messages and it will only assign the online queries to live agent when required. This can effectively minimise the need of live agent while help the organisation to optimise human resources for more important tasks like innovation and in the meantime achieve cost efficiency.

2. Enhance Customer Experience & Coverage Personalisation

AI enables a seamless automated buying experience that can generate customers’ geographic and social data using chatbot that allow users to customise coverage for specific items and events. (Source from Emerj) This could efficiently shorten the buying process and improve quality of interactions to retain customer satisfaction while ultimately reduce operational risk.

3. Minimise Fraudulent Loss with Automated Fraud Detection System

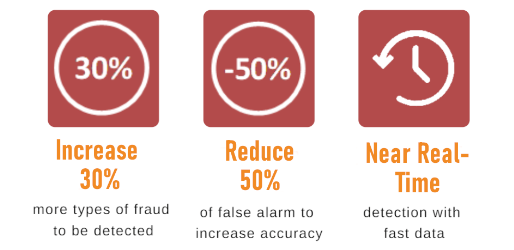

A high accuracy fraud detection system is essential for the insurance sector during this moment to mitigate fraud risk. AI and machine learning help to enhance fraud detection accuracy, increase the detection rate of fraud activity by 30% and reduce 50% of false alarm that reduces the wastage of resource and time allocated for further investigation and most importantly to avoid unpleasant fraudulent loss.

4. Improve Claim Management with AI

A claim application for customers to apply claims which embedded with AI and ML can perform faster claim process compared to manual process. Ant Financial claims that the AI-powered claim system assesses to the accidents and handles claims 68 times faster than human claims adjusters based on a study from Towards Data Science. Since there is a potential of special government enforcement on releasing infectious claim for certain policies, an efficient and high accuracy claim system is extremely important for the insurance sector to reduce fraud while mitigating business risk.

A Crucial Moment for Insurance Industry to Adopt AI

Covid-19 might not cause direct negative impact on insurance sector in short term. However, there are still a lot of uncertainty that could affect the insurance sectors if the pandemic disease is prolonged or still out of controlled. Thus, precautions for all potential risks must be taken during this uncertainty period with a better long term planning and AI adoption is one of the most efficient method that helps organisations to optimise desired results.

For more on digital transformation strategies for insurance industry, check out our blog “4 Digital Transformation Strategies for Insurers to Speed Up Success?”.