5 Effective Bank Debt Collection Strategies that Minimise Non-performing Loans

There are various types of business strategies for the organisations to optimise revenue by triggering consumers purchasing decision and providing services or products to customers with alternative payment options. Offering debt in the form of loans is one of the business strategies for the banks to gain interest by compensating the risk of defaults. On the other hand, for retailers to encourage the customers to drive purchasing decision for certain products or services without paying the full amount in advance. Another type of business strategy is the recurring payment model for industries like insurance, telco, and utility to provide services with periodic payment methods that are usually contract-based. However, ensuring a low non-performing loan is not an easy task because it requires times and human resources to go through the entire collection process for each potential defaulter. Imagine your existing human resources are capable to handle a maximum of 1000 defaulters per month, how many more human resources you will need when there is a sudden increase in defaulters due to an economic downturn. Thus, some automation workflow is extremely important in ensuring a low default rate and reducing non-performing loan, in the meantime, optimise the available resources to enhance business efficiency.

Based on the research from S&P Global Ratings, Asia-Pacific banking’s non-performing assets and credit losses could rise by US$600 billion and US$300 billion respectively in 2020 due to the pandemic, the oil price shock, and market volatility. During this difficult moment, it caused financial pressure to the debtors and customers, so how can you ensure they will pay you first instead of paying to the other organisations that they owed money to. There are 5 essential strategies that could help your organisations to enhance your collection process but before that, let’s understand what are the typical issues that are existing in the traditional collection process.

Traditional collection process

- Credit Assessment – Credit assessment in traditional processes involves manually checking applicants’ credit behaviour using internal or external credit scoring systems.

- Loan Approval and Payment Journey – After approval, customers begin their payment journey, requiring organisations to monitor payments for timely collection.

- Late Payment Detection – Late payments are identified and logged in a collection database to prepare for follow-up actions.

- Follow-Up with Default Customers – Defaulting customers are contacted by desk collectors, and in severe cases, field collectors may engage directly.

- Debt Recovery – Unpaid debts may be escalated to third-party collection services to recover outstanding amounts and manage delinquency.

Problems in traditional debt collection/ recovery

- Time-consuming and insufficient workforce – manual credit assessment is time-consuming and it may cause erroneous during the approval process due to human error; manual collection process that purely relies on human resources to monitor and track debtors’ payment and follow up all the debtors may experience insufficient workforce when there is an unexpected increase in defaulters.

- One-size-fits-all communication methods – not all defaulters have the same profile, background & behaviour, thus a cookie-cutter approach that often adopted by lenders may not bring significant effect.

- Inappropriate tones and actions – the debtors may feel threatened by the desk collectors or field collectors with the harass typed calls and messages at an inconvenient time.

- Customer’s inability to pay – continue to harass the debtors persistently by mass calling or texting instead of coming up with a guided solution to lead the debtors who are in financial difficulties will not encourage the debtors or customers to pay on time.

.jpg?width=600&name=pexels-angrycall(Red).jpg)

5 strategies should be applied to enhance debt collection

-

Monitor Customers Behaviour

Data-driven customer process is essential to better understand your customer behaviour and map customer journey. The process of aggregating data across all lines of business including structured and unstructured data can provide a holistic customer view while eliminating the data silos issue. This process enables the debt collectors to identify the key characteristics of defaulters and trends and patterns of the debtors with potential high default risk.

![]()

-

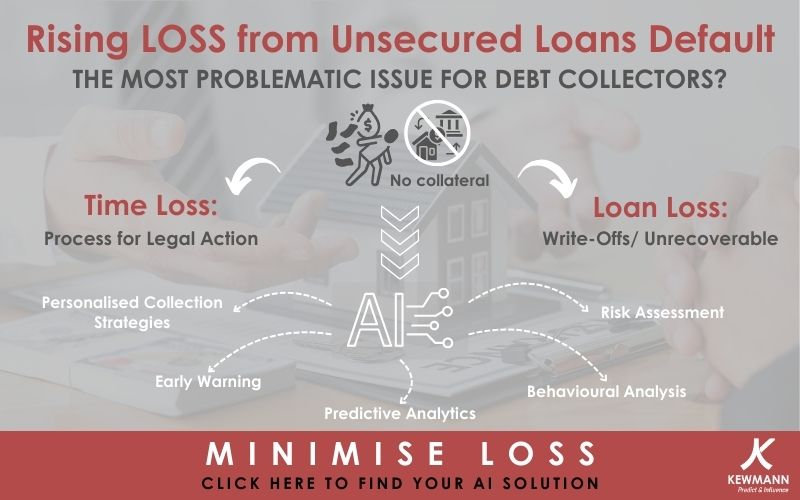

Leveraging on Alternative Data

Alternative data is critical to create a successful collection process by improving the data quality before moving to the next collection step because inaccurate and outdated data does not serve the purpose to achieve high collection efficiency. All internal data include structured and unstructured data across all departments and the online data sources especially those that provide indications of actual & current situations should be utilised to enhance analytics results. The impact of external factors shouldn’t be neglected too since it could directly affect the debtor’s or customer’s behaviour. Therefore, external data such as market trends, gaps and risks should be included when performing big data analytics and predictive analytics. Artificial Intelligence must be embedded in this process to achieve nearly-real time data aggregation to enhance business insights and improve the accuracy of prediction for a more effective collection process.

-

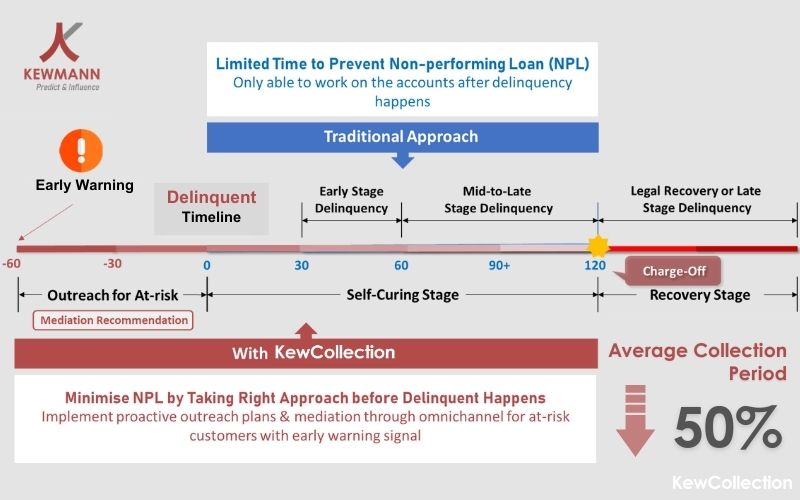

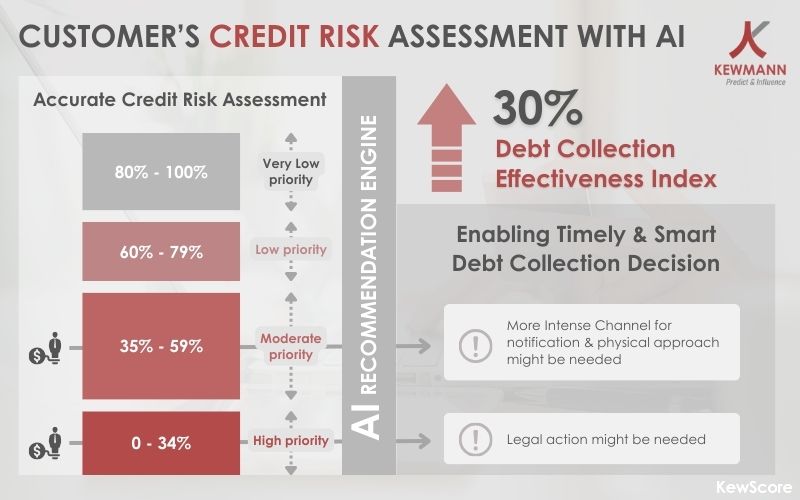

Early warning through Dynamic Models

Ruled based approach is the typical approach for most of the debt collectors in indicating the debtor’s ability to pay and the data is largely static. This approach is no longer effective enough to provide on-time insights to the lenders especially in this fast-changing era because it is a lagging indicator that is not able to capture the latest change in trend and patterns of debtor’s credit risk. A dynamic collection propensity scoring model is a leading indicator that improves indication accuracy by including both static and dynamic data. Advanced technologies like AI and machine learning are employed in the dynamic model to classified debtors into various segments in nearly real-time for downstream processes and integrate with an early warning system to quickly alert and identify red flags for proactive outreach plans.

-

Provide Mediation Recommendation

The traditional approach is no longer effective enough to drive repayment action since one debtor may hold more than one debt and not all of them may care about the delinquency consequences especially when they are under financial pressure due to an economic downturn. Thus, providing a mediation recommendation to the potential default debtors could result in a win-win situation If the organisations policies permit. A targeted mediation plan based on the latest situations of the debtors (such as reduce income short term) and powered by AI recommendations such as extending the payment period and lowering the monthly payment could encourage the defaulters to pay your debt first among the rest of the debts which reduce your non-performing loan and delinquencies rate.

-

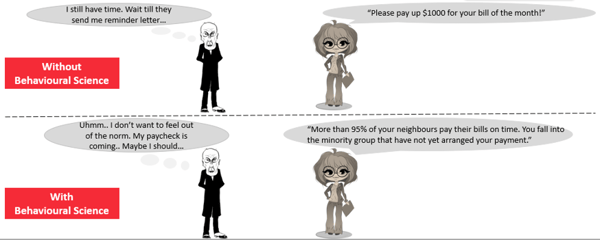

Leveraging Behavioural Science throughout the Process

All applications are made for humans, either for internal employees, consumers, or other third-party entities. Thus, understanding human behaviour based on your data allows you to understand the underlying behaviours of the debtors first before tailoring the approaches accordingly. Behavioural Science methodologies can be embedded into analytics for effective segmenting the debtors and customers so that you can select the right approach to the right debtors at the right time. People react to a choice depending on how it is presented. By apply behavioural science in the system, you are able to create great design personalised messages and channels to elicits positive responses from the debtors. A government tax department added one sentence in the tax notice based on the behavioural recommendation and it resulted in 66% more tax collection.

The Future of Bank Debt Collection

The collection process is no longer as simple as previously because the number of debtors will not be reducing in time and the debtor’s behaviour will differ as to the previous generation. How can you ensure the debtor will pay you first and how can you optimise your resources to improve collection efficiencies? Here’s your solution: The enhanced approach with the above 5 strategies will not only help your organisation to survive an unexpected event but also allow you to achieve your desire outcome with high debt collection efficiency.

For insights on leveraging technology in combating financial crimes, explore our blog on “4 Innovative Safeguards: Technology’s Role in Anti-Money Laundering for Insurance“

Discover more to get a hint on your upcoming technologies intervention: