The Top Secret: How to Influence the Right Targets Precisely

Optimise revenue and increase profit are always the main goal for every organisation. One of the most direct ways to gain profit is by improving sales performance. Every organisation will also have their target audiences that they hope to be influenced to drive sales. However, it is not an easy task to influence someone to achieve your desired outcome. If the influencing approaches are not being done correctly, it may cause negative outcomes to the organisations such as waste of resources, loss from investments or fail to retain customers. Gaining the power to influence human behaviour is possible! Here’s the top-secret that being revealed about how advanced technologies could help in predicting while influencing the right targets:

Questions in mind before influencing any desire targets:

- How do I improve public perception and acquire new customers to increase revenue?

- How do I get my sales staff to sell, sell more, sell efficiently and effectively to increase sales?

- How do I get my customers to buy, buy more, stay loyal and be an advocate to increase revenue?

- How do I get my workforce to stay loyal, remain engaged and improve organizational performance?

Common approaches to influence the target audiences

Target audience 1 – Customers:

- Huge Investment on Advertisement -The purpose of investing in online or offline advertising is to increase brand awareness, attract the audiences to visit the company websites or social media platforms to explore products or services, ideally interact with them or directly purchase their products or services.

- Social Media Outreach – Promoting the latest deals or promotions by sending messages to all the existing followers or subscribers through all social media platforms.

- Multiple Call or Message Attempts – One of the most common ways to influence the potential leads that had shown interest previously is multiple calls or message attempts. For example, salespersons will tend to arrange further discussion such as face-to-face meeting by frequently calling or sending messages to the customers to try to convince the customer from purchasing a product or service in order for them to close a deal.

- One-size-fits-all communication methods – Some organisations will structure or create some one-type fitted communication methods like a cookie cutter approach to react or reach to the customers or target audiences. The influential results for this approach will not be as good as expected since not all customers have the same profile, background, behaviour, etc. For example, some debtors or collectors like banks, insurers, or government tax department, will send standardized recorded voice messages to remind the clients to pay the overdue loan or premium.

- Email marketing – Sending marketing emails to the existing database is one of the ways to convert potential target audiences from awareness stage to consideration stage, in a better case from consideration to conversion stage which commonly include a call-to-action button. However, 54% of all emails are classified as spam based on Statista (Source: B2C)

Target audience 2 – Employees:

- Putting pressure on the employees – The simplest and cheapest way for the employers to push performance is putting pressure on the employees, for example, scold the employees or threaten the employees when they did not achieve or over-achieve their targets.

- Incentive or bonus for over-achievement – Organisations will provide incentive plan or bonus plan to encourage employees to work harder in order to over-achieve their targets.

- Track employees’ activities – Some of the organisations apply workforce management software to perform time and attendance tracking, labor scheduling, compliance monitoring, task management and more. Another commonly seen way is requiring the employees to punch their cards whenever moving in to the office or out from the office.

But… Are they actually being influenced or annoyed?

Most of the approaches above are possible to brings a positive outcome. However, when you go back to the questions in mind, can you really ensure the approaches are able to achieve your desired outcome or it’s just a “trying” approach with the random outcome? Can you ensure you have selected the right targets to be influenced? When you trying to apply some approaches to influence the target audiences, the outcomes can be kind of extreme which means, the target audiences will be either successfully influenced or successfully being annoyed which in the worst case, loss the customer due to bad experience. During this rapid advancement of technology era, a better way that helps to achieve desired outcomes is available by better understanding your target audiences behaviour and influencing your target audiences intelligently without being pushy or annoying.

A better way – Understand your target audiences & Influence the right targets

Advanced technologies that should be involved:

1. Acquiring data with Artificial Intelligence tools

To be able to understand more about your target audiences, you need to have sufficient data in order to have a single holistic view of customer data. Thus, acquiring all relevant internal and external data are an important stage before carrying out further step to predict or influence your target audiences or behaviour. AI-driven data acquisition and data integration helps the organisation to acquire, store and mash-up all relevant internal and external data from multiple sources including both structured and unstructured data that provide a more holistic view of your customer data in nearly real-time to enhance the analytics results.

2. Understand and discover target audiences behavioural change with big data analytics

Once the relevant data sources or datasets are mashed-up, big data analytics can be applied to examines the huge amount of acquired structured and unstructured data to uncover trends & patterns about customer behavioural changes with visualisation.

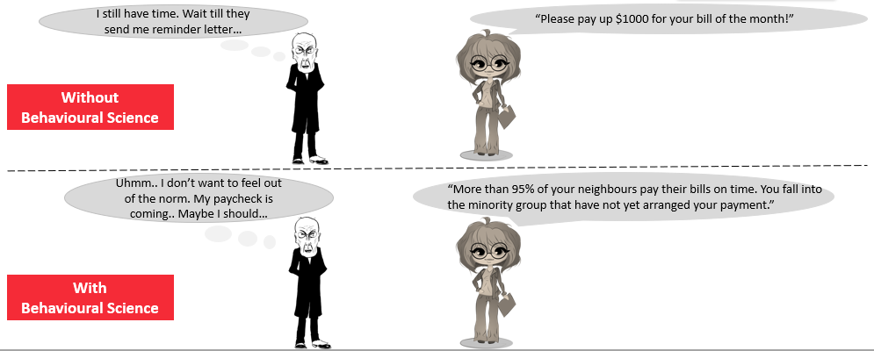

3. Apply Behavioural Science theories to understand human behaviour

Behavioural Science models like Fogg Behaviour Model, Flow Theory and more can be involved in the analysing and predicting process to identifies ingredients for behaviour change. It can help the organisations to understand how the target audiences make a decision and identify predictable patterns in human behaviour based on big data analytics results. The target audience behaviours can be reshaped according to the analytics results to improve the influential power.

4. Deploy an influential platform to influence the right targets

After having a deeper understanding and insights about the human behavioural changes and decision making, an influential platform can be taken in placed to influence the target audiences effectively. For customers, a nudging effort can be deployed based on the identified behavioural changes to indirectly influence the target audiences to drive certain action while improving customer experience. On the other hand, the organisations can apply gamification method to integrate with an incentive planning to improve employee’s daily activity while motivating them to reach a higher target to win a certain desired rewards.

Why is it different from the traditional approaches?

- Understand the underlying behaviours first before tailoring any approach

Instead of guessing or refer to the default behaviours, organisations should fully utilise the available internal data and the external data to understand the underlying behaviours and reshape the target audience behaviours timely in order to tailor better approaches accordingly.

- People react to a choice depending on how it is presented

Great designs such as personalized messages, channels and more elicit positive responses compare to the one-size-fits-all method.

- Intelligent segmenting the target audience to the right approaches at the right time

Once you are able to identify and reshape the target audiences behaviour into different groups, you can apply different effective approaches which recommended by the systems to enhance the influential results at the right time.

- Trigger the subconscious and unconscious mind to drive actions

The subconscious and unconscious mind are hard to trigger but the influential power is very hard if its successfully being triggered. By applying Behavioural Science theories, the system will be able to produce nudging efforts based on the analytics outcome to influence the target audiences unconsciously without being annoying or pushy to the target audiences.

Type of Use Cases and Benefits:

- Selling and Buying – Drive target audiences action to purchase with nudging efforts and salesperson to increase sales activities with gamification method in order to increase sales performance and optimise revenue.

- Collection – Improve collection efficiency such as loan repayment, insurance premium payment and tax payment to ensure cash flow by intelligently segment the customers into different paying ability level and willingness to pay to apply with different suitable approaches. For example, a simple reminder is enough for the group of customers that are able to pay and willing to pay, while on the other hand, a small amount repayment strategy can be applied to the group of customers that are unable to pay but they are willing to pay.

- Virtual Engagement – Enhance online present with 24/7 availability to deliver useful information and engage with target audiences to achieve certain influential effect rather than focusing on physical present such as physician and patient engagement platform, government as a platform, etc. to reduce resources on-site, achieve cost efficiency while improving customer experiences.

- Workforce Management – Enhance employee’s performance through gamification and integrate with the work process to monitor employee’s activities, understand their behaviours and motivating employees from achieving certain targets to get certain desired rewards. It can also build a competitive environment to boost performance by showing the leader board based on the scoring of virtual rewards like coins, points, diamonds, etc.

The effects with and without behavioural science for collection

The Secret Recipe to Ensure Outcomes –> Behavioural Science

The world keeps changing, human behaviour will not always be the same as a few years ago. The traditional methods of influencing the target audience are no longer as efficient as before. We always have the most resourceful asset on hand, the DATA, but if we do not utilise it right, it will only become a bunch of junk or even liabilities to us. When you unleash the power of data with the combination of right technologies and behavioural science, you will be able to have a deeper understanding on your target audiences and perform a more accurate predictive analysis while influencing the right targets precisely to ultimately achieve your desired outcomes and business goals. It’s the time to be advanced smartly with the right tools and methods, traditional ways might be easy to conduct but why not perform a better way to ensure outcomes and optimise your revenue.