How to Ensure All Frauds Have Been Detected? A Million Dollar Fine Being Imposed to A Bank Due to Frauds! [Warning to Financial Institutions]

Frauds and compliance issues are on the rise with each passing year which has become a serious hidden threat to organisations since the business trends and consumer behaviours are shifting online. The exponential increase in online and virtual activities makes organisations more vulnerable to fraud especially for organisations that deal with a massive amount of online transactional activities, which some of the financial institutions have been suffering from. An International Criminal Police Organisation (INTERPOL)-coordinated operation codenamed HAECHI-I focused on online financial crime across the Asia Pacific region has opened more than 1,400 investigations during the six-month operational phase, 892 cases were solved while many of which remain ongoing. (INTERPOL, May 2021) These amount of cases are only the reported cases, imagine how many more financial fraudulent activities out there are still hidden in the organisations.

The Negative Impacts of Undetected Fraud on Financial Institutions

- Increasing financial loss from hidden fraud When frauds went undetected, organisations could face serious negative impacts. First of all, the hidden ongoing frauds will cause financial loss to organisations. The loss may keep increasing until the hidden fraud has been found out and the right action has been taken. This has commonly happened to organisations that purely rely on manual audit and the organisation only found out potential frauds when figuring out unusual loss incurred during the auditing and require more time for investigation. INTERPOL intercepted USD 83 million against online financial crime in just a 6-month operation for the reported frauds, imagine how many more frauds could be behind the scene and continually causing losses to the organisations until they finally find out the fraud.

- Huge loss due to fine incurred by the government

The Future of Fraud Detection System

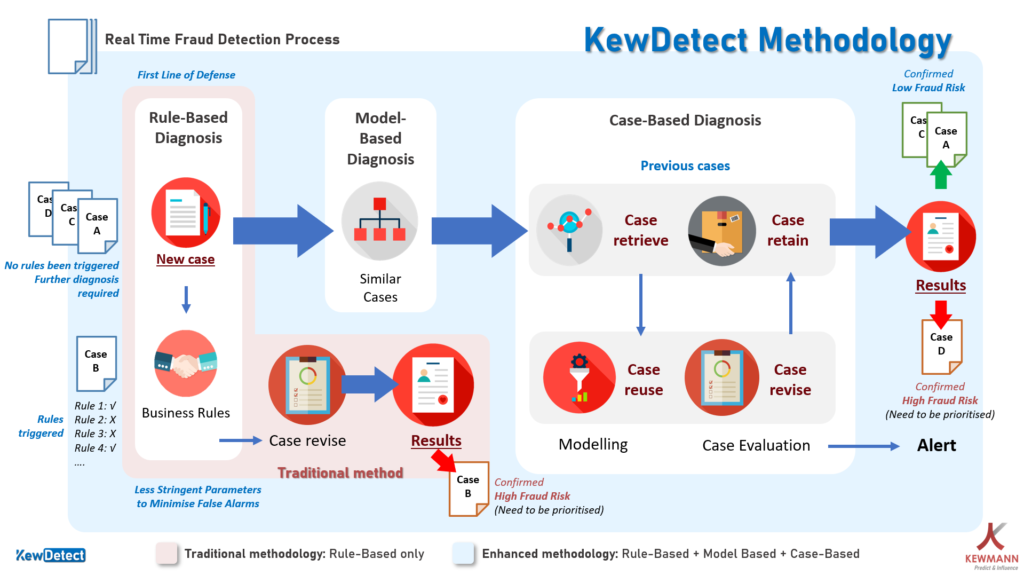

The current typical fraud detection methods could be useful but most of them have their weaknesses like the blind spots that leave gaps for the fraudsters to take advantage of. For example, the most common traditional fraud detection method which is only applying the rule-based methodology relies purely on the experience of the fraud experts. It leads to a high chance of human errors in detecting frauds if the fraud experts are not able to update new rules on time or fail to figure out the new fraudster pattern which causes high false alarms and an increase in fraudulent loss. Therefore, an enhanced fraud detection system is needed for the financial institution.

- High accuracy of insights & intelligent use of data: An enhanced approach with the ability to combine structured and unstructured data across the line of business and even the alternative data like the online data points from the website and applications are compulsory for the financial institutions to deal with the rapid increase in daily online activities and changes in human behaviours in the initial phase of fraud detection. The comprehensive data acquisition & consolidation and the ability of intelligent use of data allows the financial institutions to gain deeper insights about consumer digital footprints and the latest fraud trends which ensure minimal false alarm and generate greater accuracy insights.

- Find anomaly behaviours with network analysis: The use of network analysis in fraud detection could analyse the anomaly behaviour correlated across channels and detect organised crime and collusion based on the analysis of the relationship. It’s increasingly important for financial institutions to be able to analyse suspicious transactional frauds as quick as possible since online transactions nowadays can just be done in a few seconds. Network analysis could directly provide a 360-view about the case and the anomaly behaviour in just a few clicks to save investigation time and also improve operational efficiency for the financial institutions to make quick decisions to tackle the frauds.

- Leave no gaps for frauds by applying proven methodology: In addition, the fraud detection system should apply more than one fraud detection method to enhance detection correctness by filling each other’s potential gaps. Rule-based diagnosis is useful as the first line of defence but cases that are not triggered by the rules need a further diagnosis because there could be new fraud patterns that are not included in the rules. Including machine learning methods (model-based) and case-based diagnosis allows financial institutions to reduce false alarms and even “codify” new frauds seamlessly to leave no gaps for frauds. An automated AI-based fraud detection model is also a must to enable organisations to enhance fraud detection accuracy and detect more types of new frauds to prevent fraudulent loss and damage in nearly real-time.

The Fraudster will Never Stop Looking for Blind Spots

To be able to detect fraud is not enough for the financial institution to tackle the rapid increase in online activities. The ability to detect fraud accurately and detect new fraud patterns in nearly real-time is critical to minimise the organisation’s fraud and compliance risk that could reduce fraudulent losses and damages. One of the largest Asia banks successfully increased 30% more types of fraud to be detected and reduced 50% of false alarms that optimised fraud detection accuracy with KewMann. The fraudsters will never stop looking for gaps to conduct frauds, thus financial institutions must always evolve in tackling fraud and compliance risk to “leave no stone unturned” -with KewDetect.